Beijing is readying a stimulus package to boost its stuttering economy following the central bank’s interest rate cuts earlier this week. How much of a boost the increased spending will be to the deflated global dry bulk scene remains to be seen.

JPMorgan Chase, UBS and Standard Chartered all trimmed their 2023 gross domestic product growth forecasts to 5.5% or lower this week after official figures for retail sales growth and fixed asset investment slowed in May and undershot expectations.

“While we expect China to introduce additional policy support to safeguard a continued economic recovery, we think the likelihood of a big stimulus is low,” economists at Standard Chartered cautioned in a note to clients yesterday.

The scale and scope of any stimulus remains a secret with UBS pointing to a Politburo meeting in July as a likely time for measures to be announced, including how to resuscitate the ailing real estate sector.

Over the past 10 years, China has accounted for about half of the growth in seaborne dry bulk trade. A large part of the growth from China can be attributed to the high investments in the real estate sector, something that has been battered in the last 18 months.

The International Monetary Fund currently projects the Chinese economy to grow by 4% from 2022 to 2027. However, much of this growth is expected to come from private consumption and not fixed investments, such as real estate. Investments in the real estate sector experienced – for the first time since 1997 – negative growth of 10% in 2022, as a result of the ongoing real estate crisis.

“Little seems to indicate that government stimuli will lift the real estate sector. The rebound in the Chinese economy may therefore not benefit capesize and iron ore carriers to any great extent, although they carried around 90% of total iron ore volumes to China in 2022,” a recent report from Danish Ship Finance argued.

Analysts at investment bank Jeffferies lowered their estimates and targets for listed dry bulk firms 10 days ago, citing the weaker China steel outlook.

“So far in 2023, charter rates have averaged similarly to those seen in the tough years pre-2021. China’s re-opening has led to higher steel production and iron ore imports, but a sustained recovery seems farther away given the correction in steel prices recently. An expected China stimulus could be a positive near-term trigger, however,” Jefferies noted in a report issued on June 6.

Analysts at shipbroker Arrow noted yesterday that over the past few weeks, the souring economic outlook from China has very quickly fed into the dry bulk spot market.

“The sentiment and selling pressure is flowing from the macro environment into the chartering market via the FFA market,” Arrow explained.

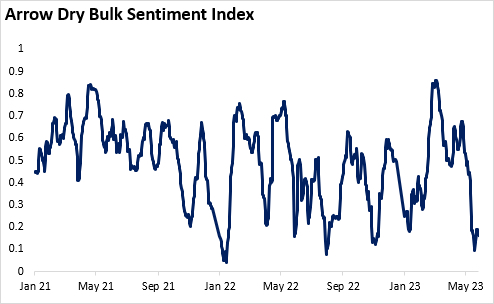

This poor sentiment in the chartering market is evident in Arrow’s Dry Bulk Sentiment Index (see below), which is around the lowest level on record since the index was created at the start of 2021. This index is built using daily chartering reports, analysing the positivity/negativity of the language used.

“Weakening China-related commodities, property stocks selling off, economic data disappointing all combined to generate poor sentiment, whilst FFA market activity perhaps accelerated this trend. The spot market moved much faster than we expected,” Arrow admitted.

“2023’s recovery in China’s industrial sector has clearly continued to stall and youth unemployment in China also continues to set new records,” a new report from dry bulk advisory Commodore Research observed.

“Speak to dry bulk owners, and there is a morose temperament setting in, the market has failed to fire, despite seemingly benign supply fundamentals – the rest of the year could prove a damp squib, hence the decision by big names such as Swire Bulk and Pacific Basin to start closing regional offices. As ever, when it comes to dry bulk, all eyes are on China,” a report carried in the May issue of Splash Extra noted.